Under the Revised Corporation Code of the Philippines (2019), a One Person Corporation (OPC) is expressly defined as “a corporation with a single stockholder,” subject to special governance rules, including the absence of by-laws. Ordinary stock corporations, by contrast, are governed by the general provisions of the Code, which apply suppletorily to OPCs unless inconsistent.

Philippine jurisprudence consistently emphasizes that corporations are creatures of law. They exist and operate only within statutory parameters, and corporate powers are exercised in accordance with legally prescribed governance structures, most notably through the board of directors in ordinary corporations. This principle was underscored by the Supreme Court in Ago Realty & Development Corp. v. Ago G.R. No. 210906, October 16, 2019).

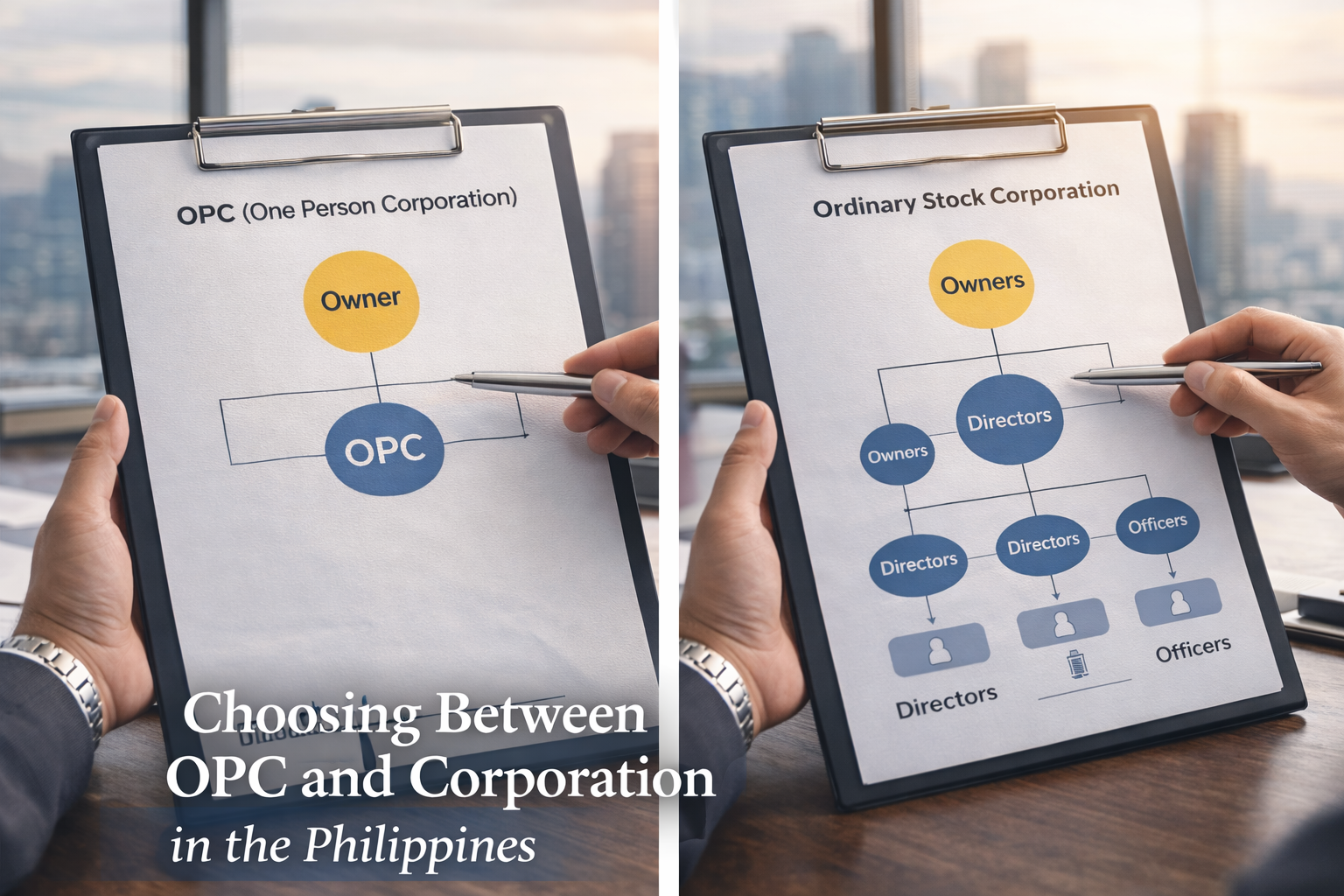

Practical implication: choosing between an OPC and an ordinary corporation is not a mere SEC filing decision; it determines how control, liability, and decision-making will legally function.

How Founders Typically Choose in 2026

In practice, founders in 2026 usually choose between:

- OPC – single ownership, centralized control, streamlined governance; or

- Ordinary stock corporation – multiple owners, board-driven governance, and scalable equity structures for co-founders or investors.

Bottom-Line Conclusion

Because an OPC is legally optimized for single ownership and simplified governance, it generally performs better for solo founders who can maintain strict separation between personal and corporate assets.

Conversely, because ordinary stock corporations are structurally designed for multi-owner decision-making, board governance, and equity scalability, they are generally superior when there are—or will be—multiple stakeholders.

Which Is Better in 2026?

Choose an OPC if:

- You have one real owner holding 100% of the shares

- You want maximum control with minimal internal approvals

- You prefer simplified governance (no by-laws)

- You can strictly maintain asset and accounting separation

Choose an Ordinary Stock Corporation if:

- You have two or more owners, now or in the near future

- You expect outside investors or employee equity

- You need board governance and delegated authority

- You want custom by-laws for voting, deadlocks, transfers, and dispute prevention

1) OPC: What it is—and who may form it

“A One Person Corporation is a corporation with a single stockholder: Provided, That only a natural person, trust, or an estate may form a One Person Corporation.”

— Revised Corporation Code, Sec. 116

Practical impact: OPCs are ideal for solo founders, but are unavailable to certain regulated entities (e.g., banks, insurance companies) and generally unsuitable for the practice of professions unless special laws allow otherwise.

2) OPC has no by-laws requirement

“The One Person Corporation is not required to submit and file corporate by-laws.”

— Revised Corporation Code, Sec. 119

3) Liability protection comes with a statutory warning

“A sole shareholder claiming limited liability has the burden of affirmatively showing that the corporation was adequately financed.”“Where the single stockholder cannot prove that the property of the One Person Corporation is independent of the stockholder’s personal property, the stockholder shall be jointly and severally liable…”

— Revised Corporation Code, Sec. 130

Meaning in practice: OPCs provide limited liability only if you operate them like real corporations—separate bank accounts, proper capitalization, and clean records are non-negotiable.

4) OPC governance defaults

“The single stockholder shall be the sole director and president of the One Person Corporation.”

— Sec. 121

“The single stockholder may not be appointed as the corporate secretary.”

— Sec. 122

Practical impact: you control the company, but you must still appoint another natural person as corporate secretary.

5) Corporations are creatures of law

“[C]orporations are creatures of the law… [t]o organize a corporation… is not a matter of absolute right but a privilege…”

— Ago Realty & Development Corp. v. Ago (2019)

Key insight: governance structure is not cosmetic—it has legal consequences.

| Topic | OPC | Ordinary Stock Corporation |

| Owners | Single stockholder | Typically 2 or more |

| By-laws | Not required | Generally required |

| Control | Sole stockholder = director & president | Board exercises corporate powers |

| Corporate Secretary | Cannot be the stockholder | Separate officer required |

| Liability risk | Statutory burden on sole stockholder (Sec. 130) | Veil-piercing doctrine applies |

| Best for | Solo founders, holding companies, Trust | Co-founders, investor-ready venturesCapital, Tax, and Compliance Considerations |

Capital, Tax, and Compliance Considerations

Both OPCs and regular corporations are subject to:

- Corporate Income Tax

- Registration with the Bureau of Internal Revenue

- Issuance of official receipts

- Annual SEC and BIR filings

However, practical differences arise:

OPC

- Simpler reporting structure

- No need for board resolutions

- Ideal for service-based or owner-operated businesses

Regular Corporation

- Better suited for:

- Multiple shareholders

- Equity investments

- Joint ventures

- Stronger credibility with banks and institutional partners

Common 2026 Scenarios: Fast Decision Guide

- Solo founder → OPC

- Two co-founders → Ordinary corporation

- Planning to raise capital → Ordinary corporation

- Single-owner holding company → OPC (with strict asset separation)

- Plan to add owners later → Start as OPC, convert later (Sec. 132)

When an OPC Is the Better Choice

An OPC is generally more suitable if:

- You are a solo founder

- You want limited liability without complex governance

- The business is small to medium-scale

- You do not plan to raise capital from investors

- You want lower ongoing compliance costs

Typical OPC users: consultants, professionals, freelancers, small business owners, holding companies.

When a Regular Corporation Is Better

A regular corporation is often the better option if:

- There are multiple owners or investors

- You plan to raise capital or issue shares

- Foreign ownership or equity structuring is involved

- The business operates in a regulated industry

- Succession planning is important

Typical users: startups, family corporations, real estate companies, joint ventures, growth-oriented enterprises.

Common Mistakes When Choosing OPC vs Corporation

Mistake 1: Treating incorporation as a mere formality

Risk: governance disputes, invalid acts, investor red flags.

Mistake 2: Sloppy incorporator or recordkeeping issues

While courts recognize curable defects (e.g., SEC v. AZ 17/31 Realty, Inc., 2022), amendment, not complacency, is the proper remedy.

FAQs

Is OPC better than a corporation in the Philippines?

An OPC is a corporation. It is generally better for solo owners seeking simpler governance.

What is the biggest disadvantage of an OPC?

The statutory burden to prove asset separation and adequate capitalization (Sec. 130).

Can I convert my OPC later?

Yes. Conversion is expressly allowed under Sec. 132.

Because the Revised Corporation Code creates a simplified corporate structure for single stockholders while imposing specific liability safeguards, an OPC is generally the better option in 2026 for disciplined solo founders. Because ordinary corporations are designed for board-based, multi-owner governance, they remain superior where multiple shareholders, investors, or complex decision-making are involved.

Both One Person Corporations and ordinary stock corporations are registered and regulated by the Securities and Exchange Commission (SEC), which issues the Certificate of Incorporation and enforces corporate reportorial requirements.

After incorporation, OPCs and ordinary corporations must register with the Bureau of Internal Revenue (BIR) for tax compliance, issuance of official receipts, and filing of required returns.

This decision should be evaluated together with Choosing the right business structure in the Philippines, which discusses sole proprietorships, partnerships, corporations, and OPCs in detail

GET IN TOUCH

Schedule a Consultation

Location

Soho 207 Mckinley Park Residences, 3rd ave. cor. 31st St., BGC, Taguig, Philippines, 1635

Contact us:

Email: executive@romualdezlaw.com

Contact Number: +63 952 489 1738